We’re moving to live execution (A-book) and bringing our platform fully in line with real market conditions.

NFA Trading, Ltd (NFA) ¹ has conducted its activities to provide traders with as realistic an environment as possible in which to engage in simulated trading. Now, NFA has decided that the best approach for traders is to offer live trading. Breakout is therefore transitioning to an A-book model for almost all of its funded traders.

To facilitate this transition, Breakout has partnered with a proprietary trading firm called NFA. NFA previously acted as the third-party proprietary trading firm for simulated trading using a B-book model, and going forward NFA will operate, in most cases, using an A-book model.

This is a transformative shift in Breakout’s relationship with its funded traders.

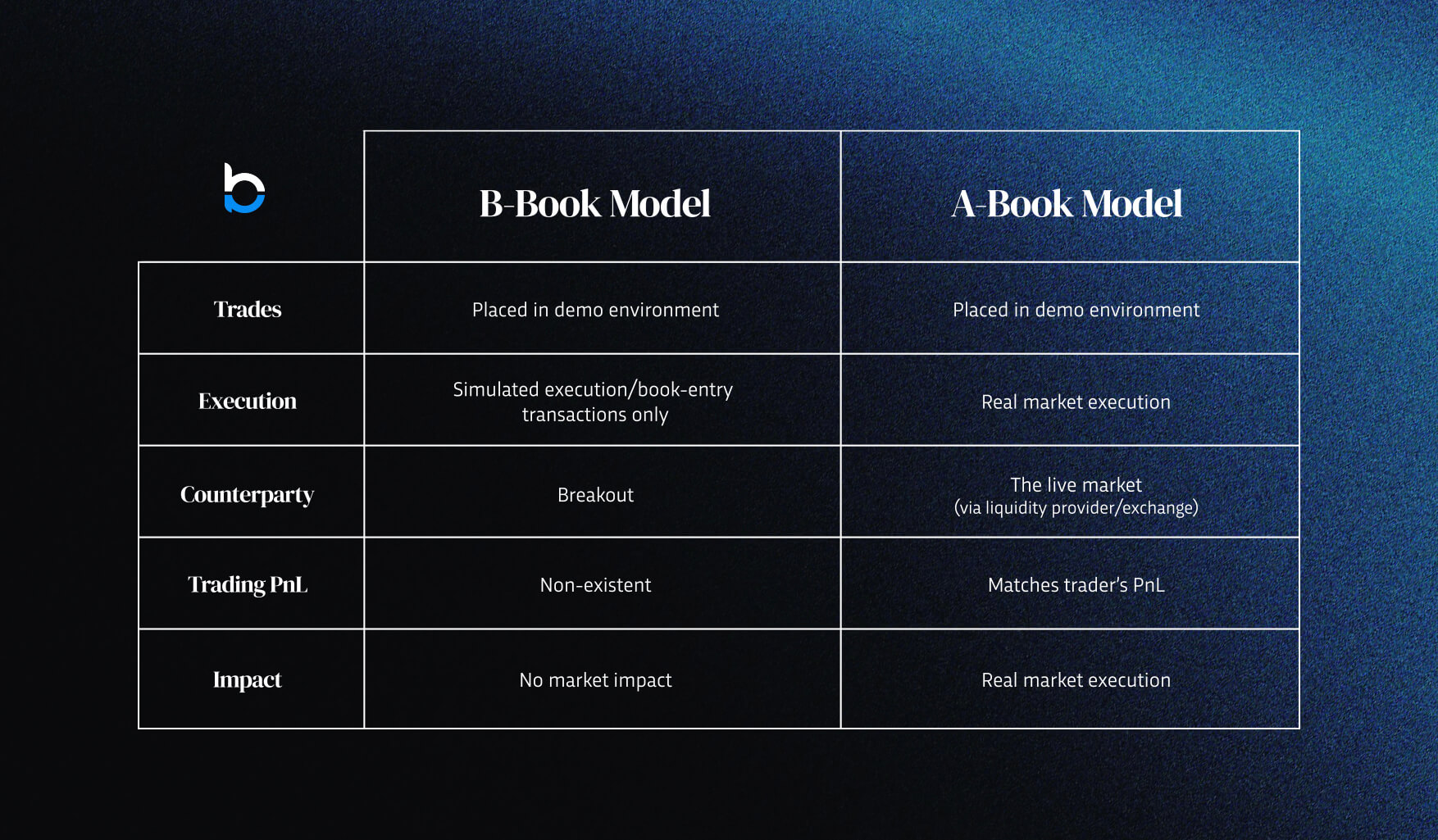

In order to understand the magnitude of this change, let’s revisit some A-book and B-book fundamentals.

In a B-book model, the firm is the counterparty to all of the orders of its traders and internalizes all of its traders’ order flow.

In simplest terms, in the B-book model, if a funded trader is short 1 Bitcoin, then the firm effectively establishes a 1 Bitcoin long on its books and records. Furthermore, most firms don’t actually go out to the live market to establish a 1 Bitcoin long. Instead, the firm just has a 1 Bitcoin short as a payout liability if the position is profitable.

In Breakout’s view, this is far from ideal. This is because, in a B-book model, the firm’s interests are misaligned with those of its traders.

Unless a proprietary firm copies or mirrors trades from a “funded” trader for its own account, every winning position a funded trader closes is an immediate cash liability for the firm. The trader’s win is the firm’s loss. The trader’s positive PnL is the firm’s negative PnL. And so on.

Breakout believes this creates a potentially adversarial relationship between the firm and its traders. Breakout also believes that this potentially adversarial relationship is the cause of many of the negative aspects and market perceptions associated with prop trading.

Consistency rules, profit caps, news trading rules, anti-gambling rules, equity-based drawdown, time limits, risk per trade rules, and all other punishing restrictions are embedded in this adversarial relationship between the firm and its traders.

In a B-book model, unprofitable traders that are not copied or mirrored become an asset, and profitable traders are a liability.

Pure B-book firms don’t make any money from trading. They’re not trading firms in any meaningful sense and generate revenue when their traders are unsuccessful. All the order flow is booked internally, and thus there’s no live trading taking place.

As such, B-book firms make virtually all of their revenue from selling evaluations. On the other side of that revenue are expenses, which primarily take the form of trader payouts and general business expenses. Profits = Evaluations Sold – Payouts – General Business Expenses.

Naturally, B-book firms try to increase their evaluations sold, but they are equally (if not more) incentivized to reduce their payouts to make the business more profitable. Hence the rules, restrictions, added slippage, ‘gotchas’, and so on. As we noted above, NFA has avoided such incentives in the past, but NFA believes the mere existence of a misalignment in interests should be eliminated.

If B-book prop firms are not copying or mirroring trades for their own account in the live market, such firms can encounter liquidity problems or default on their obligations entirely when their liabilities (payouts + general business expenses) exceed their revenue (evaluation proceeds).

In other words, pure B-book trading firms are not really trading and run the risk of collapsing from their very own traders achieving metrics resulting in payouts.

Breakout believes the entire B-book structure is misaligned. Although NFA has worked to avoid creating adverse conditions for traders as a result of such misalignment, NFA has decided to further minimize even the implication of adverse conditions. So, we’re leaving the B-book model behind.

From this point forward, almost all of Breakout’s funded traders will be A-booked by design through NFA.³

An A-book model is a trading framework where the firm routes trades for its funded traders directly to the live market to its own account(s) based on signals from its traders.

Instead of internalizing trades and acting as the counterparty (as in a B-book setup), NFA will use its own capital, in its own accounts, to place the same trades on real exchanges with liquidity providers.

If, for example, a funded trader goes long 1 Bitcoin, the firm also goes long 1 Bitcoin in the open market, using its own funds. This means the trades have real execution, real market impact, and real PnL. In an A-book model, the firm’s interests are more aligned with the interest of its traders. The better a trader performs within the set guidelines and requirements, the more the firm benefits.

There’s no inherent conflict, no incentive to create restrictions or limitations, and no internal pressure (even subconsciously) to undermine traders. It’s a structure we believe is better able to reward skill, foster trust, and reflect the reality of trading in its purest form.

By transitioning to the A-book model, Breakout’s interests are now more closely aligned with the interests of its funded traders through its relationship with NFA. NFA’s trading book PnL is now essentially the sum of its funded traders’ PnL.

The desire for funded traders to succeed is not just theoretical. It’s built into the structure of the partnership between Breakout and NFA. NFA is directly economically incentivized for funded traders to be profitable, as it earns a share of their successful payouts. This alignment drives NFA to provide what it has always aimed to offer: the best spreads, depth, liquidity, trading conditions, and maximum freedom for trading strategies.

In short, NFA is transitioning to become more of a real trading firm for which Breakout acts as the evaluating entity.

It has taken Breakout and NFA some time to work through the mechanics of transitioning from the B-book model. We are excited to transform the traditional evaluation-based prop industry to a new framework, one that more closely aligns the interests of traders and NFA in the live market with live capital and matching economic incentives.

This shift is the result of years of infrastructure development, capital formation, and strategic partnerships. Breakout and NFA have built routing systems, risk management tools, and live market access that finally make true A-book deployment possible at scale.

With this shift, Breakout and NFA reaffirm their commitment to building a platform that rewards skill, empowers traders, and reflects the reality of the markets.

We’re excited to begin this new chapter alongside the traders who made it possible.

Let’s build the future of prop trading together.

Does this change apply to my existing evaluation or funded account?

No, this change does not apply to existing funded accounts or ongoing evaluations. Current funded traders will complete their journeys on the existing B-Book model. The new A-Book model will apply only to newly funded accounts and will be rolled out in phases. As a result, not all new funded accounts will be transitioned immediately. Over time, all new funded accounts across all account sizes will move to the A-Book model.

Will I be trading with real money?

No. You will still be executing trades with demo capital in a simulated environment in both the evaluation stage and the funded stage.

Will I be A-booked in the Breakout Evaluation?

No.

What is the point of the Breakout Evaluation?

The Breakout Evaluation assesses your trading ability and fitness to become a funded trader with NFA.

Will I be trading on a centralized exchange now?

No, trading will remain simulated in the Breakout Terminal and the core experience is unchanged. The main change is in the order routing for A-booked funded traders with NFA. No subaccounts are ever created on behalf of any individual traders.

Will this change execution speed, spreads, slippage, and other parts of the trading environment?

The trading environment will remain substantially the same between the evaluation stage and the funded stage. The primary difference is that, under the A-Book model, trades are routed to live markets, and market orders interact with real liquidity. This may potentially influence the ultimate fill price(s), speed of execution and any slippage, depending on the trade size, trading pair, liquidity conditions, and other variables in the live market.

Can I still use the same trading strategies?

Yes. There are no new trading style or strategy restrictions. Traders must abide by all trading conditions and requirements in both the evaluation and funded stages.

Will there be any trading restrictions in the future?

As an A-book trading firm, NFA is actively deploying capital in the live market. As a result, NFA may choose to add or lift restrictions based on market conditions.

Are there any new rules or changes?

No.

Have the Breakout Evaluation rules changed?

No.

Can I opt out of being A-booked as a funded trader?

No.

Do I need to do anything during this transition?

No.